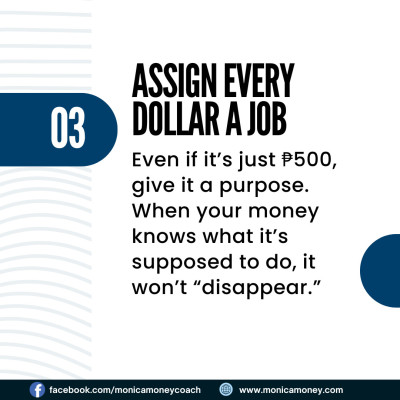

Itโs not always the big purchases that throw our finances off trackโitโs the daily habits that quietly add up. A coffee here, a takeout order there, and a few impulse buys can slowly drain your budget without you even noticing.

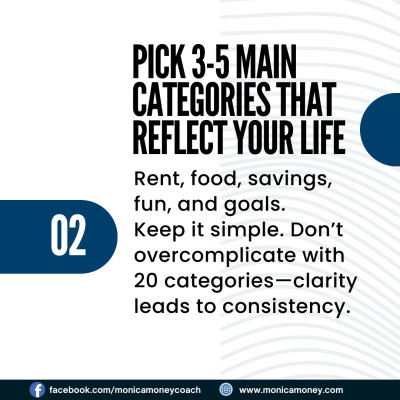

The good news? Small changes in your daily choices can create big results over time. Budgeting isnโt about restrictionโitโs about awareness and control.

Which daily habit do you think costs you the most?